Allied Air Enterprises Redesigns Armstrong Air® and AirEase® Pro Series Systems to Welcome New Low-GWP Refrigerant and Offer New Benefits

U.S. Energy Incentives

Posted on: Jan 20, 2023 by Allied Air Enterprises

The U.S. government offers homeowners a wide array of incentives, rebates and tax credits for home energy updates and upgrades. If you purchase qualifying models, you may be eligible for local energy incentives and rebates.

FAQs on What’s New in 2023

The U.S. government has passed legislation under the Inflation Reduction Act of 2022. To help you understand the changes, we've gathered all the key info you should know.

What is the Inflation Reduction Act?

The Inflation Reduction Act of 2022 (IRA) is a broad piece of federal government legislation that encourages homeowners to work toward U.S. electrification and greenhouse gas reduction goals. It covers many industries and carries a wide range of government-backed programs and incentives. Those include potential rebates and tax credits for HVAC equipment installations and upgrades that can save you serious money!

What is the difference between the tax credit and these rebate funds?

The Energy Efficiency Home Improvement Credit (25C) is a dollar-for-dollar offset on the amount of taxes you owe, up to a set amount. This tax credit is available to homeowners who purchase high-efficiency heating and cooling equipment, including air conditioners, heat pumps, furnaces and packaged units. The federal government is also setting aside 4.5 billion for rebate funds, which will be made available to states. A rebate is a payment made to you to reimburse part of the cost of a purchase you’ve already made. Each state may set unique criteria for distributing rebates, so it will be important to contact your State Energy Office for specific requirements.

Which systems qualify for the tax credit?

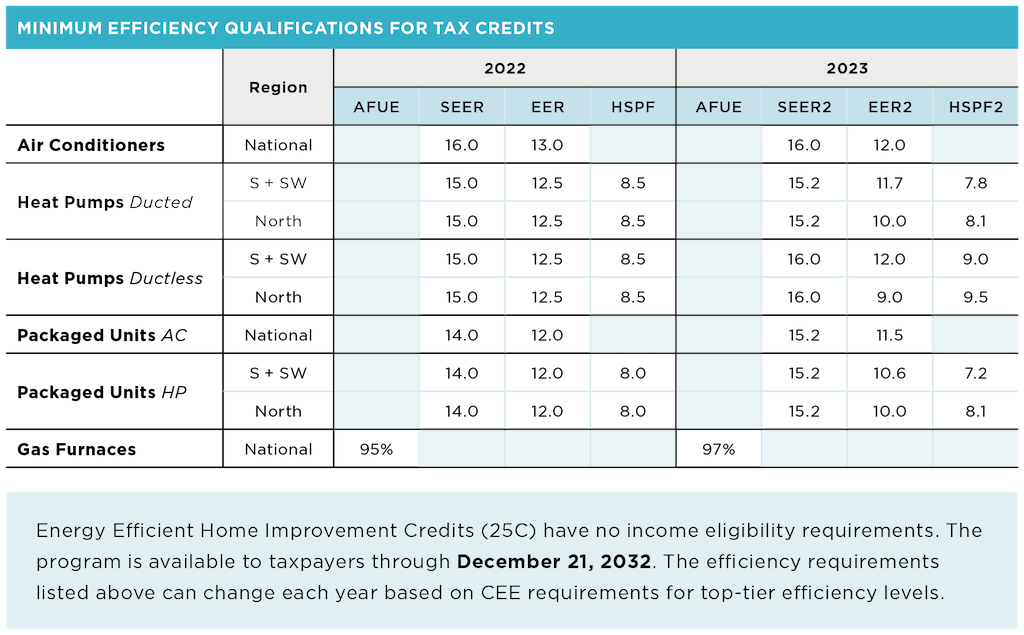

The Energy Efficiency Home Improvement Tax Credit (25C) applies to a broad range of equipment.

What’s my eligibility for a full or partial rebate?

You can obtain 100% of the rebate amount if your annual income is less than 80% of your Area Median Income (AMI). You can qualify for 50% of the rebate amount if your income is 80% or more but less than 150% of AMI. You could be eligible for up to $8,000 in rebates for qualifying heat pumps.

Can I qualify for both the tax credits and the rebates?

There are some limitations for homeowners applying for either a tax credit or rebate on their HVAC installation or upgrade. We always recommend that you consult an experienced tax professional and your State Energy Office before applying for either the tax credit or rebate to ensure your chosen equipment match qualifies.

Local energy incentives

Many high-efficiency heating and cooling products qualify for local utility and energy incentives and rebates. Your Armstrong Air professional has the latest energy incentives information available at their fingertips, so be sure to ask them for details on how to save. Additional resources such as energy.gov allow you to search for federal, state, and local incentives for your energy-efficient home improvements. Don't miss out on money-saving opportunities.

- "Heat Pumps" includes split ducted, split non-ducted packaged heat pumps

- In some cases, ENERGY STAR® qualification is dependent on the full system match. Visit the AHRI Directory for full system matches

- Also includes electrical panel upgrades, wiring improvements and insulation & sealing

Allied Air Enterprises (“Allied”) is not acting in the capacity of a legal or tax advisor and does not make any representation, warranty, guarantee or other assurance as to whether a particular match-up qualifies or is eligible for a tax credit or rebate. This document has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax or legal advice. The IRS, DOE, and state energy offices are responsible for the implementation and administration of tax certificates/rebates. There are important requirements and limitations for the homeowner to qualify for tax credits/rebates. Moreover, the laws are subject to change. As a result, Allied highly recommends that you and your customers consult with a tax advisor or attorney regarding a homeowner’s qualification for a tax credit/rebate in their particular circumstance and verify and review the applicable laws and regulations. Allied expressly disclaims all liability for damages of any kind arising out of a homeowner’s claim for a tax credit/rebate. This information is subject to change without notice.